Knowing your LPT Property ID is essential for compliance with the Local Property Tax (LPT), which is a basic component of property ownership in Ireland. This special identification number guarantees smooth processing whether you’re filing, paying, or changing your tax status.

| LPT Property ID Key Information | Details |

|---|---|

| What is it? | A unique identifier for your property for tax purposes. |

| Where to find it? | On any LPT correspondence from Revenue. |

| How to retrieve it? | Online request via Revenue using PPSN or Tax Reference Number. |

| Uses | Paying LPT, verifying exemptions, updating ownership details. |

| Contact for Help | LPT Helpline: +353 (0)1 738 3626. |

The LPT Property ID: Why Is It Important?

In order to effectively handle tax liabilities, each residential property in Ireland is given an LPT Property ID, a unique identifier. It becomes difficult to check exemptions, make payments, or access your LPT account without it.

How to Locate Your Property ID for LPT

Official mail from Revenue include your LPT Property ID and PIN. If they are lost, you can use your Tax Reference Number or Personal Public Service Number (PPSN) to make an online request via the Revenue LPT portal.

4. How to Request a Lost LPT Property ID and PIN

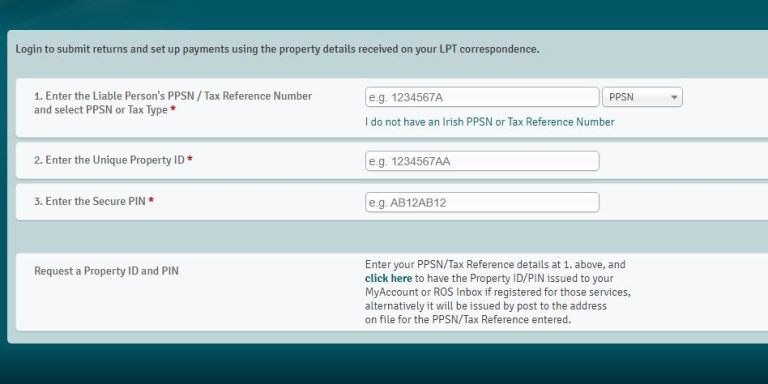

If you don’t have access to your LPT Property ID and PIN, follow these steps:

- Visit the Revenue LPT website.

- Click ‘Request Property ID and PIN’.

- Enter your PPSN or Tax Reference Number.

- Submit your request and wait for details via post or ROS inbox (if registered).

5. LPT Payment Methods and Deadlines

To maintain compliance, ensure timely payment. You can pay LPT through:

- Debit/Credit Card: Immediate processing online.

- Annual Debit Instruction (ADI): One-time deduction from a bank account.

- Monthly Direct Debit: Spreads the cost evenly across the year.

- Deduction from Salary or Pension: Automatic deductions managed by Revenue.

6. What Happens If You Don’t Pay Your LPT?

Failure to pay LPT results in penalties, fines, and possible legal action. Revenue may deduct unpaid amounts from:

- Wages or Pensions

- Bank Accounts (via attachment order)

- Tax Refunds

7. LPT Exemptions and Reductions: Who Qualifies?

Certain properties may be eligible for LPT exemptions or reduced tax rates, including:

- Newly built homes (for a specific period)

- Properties occupied by disabled individuals under qualifying conditions

- Homes affected by defective materials

Property Ownership Updates in the LPT System

It’s crucial to update your LPT status whenever you purchase or sell real estate. Up until the sale date, the seller is still liable for any unpaid LPT; after that, the new owner is required to register with Revenue.

Common Issues and How to Resolve Them

- Incorrect Property Value? You can self-assess and update via the LPT portal.

- Lost Property ID? Request it via the Revenue website.

- Missed a Payment? Settle arrears promptly to avoid penalties.

Remain Knowledgeable and Compliant

A hassle-free property tax experience is ensured by efficiently managing your LPT Property ID. You can prevent needless stress and fines by utilizing the appropriate payment methods, completing deadlines, and maintaining your information up to date.

Visit the Revenue LPT website or call the LPT helpdesk at +353 (0)1 738 3626 for official updates and support.