The London Central Portfolio, of the LCP has been comparing prime London property sales taking place last year and this year. The specialist residential property advisor mainly works in the Prime Central London sector.

The specialist property advisors have noted that price growth in the past two years has been relatively subdued. This lack of growth has been attributed to the changes that have been put in place to the residential tax regime combined with political and economic uncertainty. In the second quarter of this year the Prime Central London market has seen a slight upturn, with a 5.8% growth registered. This growth has come about when average prices reach £1.9 million. Despite the seemingly good news regarding market growth, the increase in value of sales has come about through an increase in values as opposed to an increase in the number of transactions.

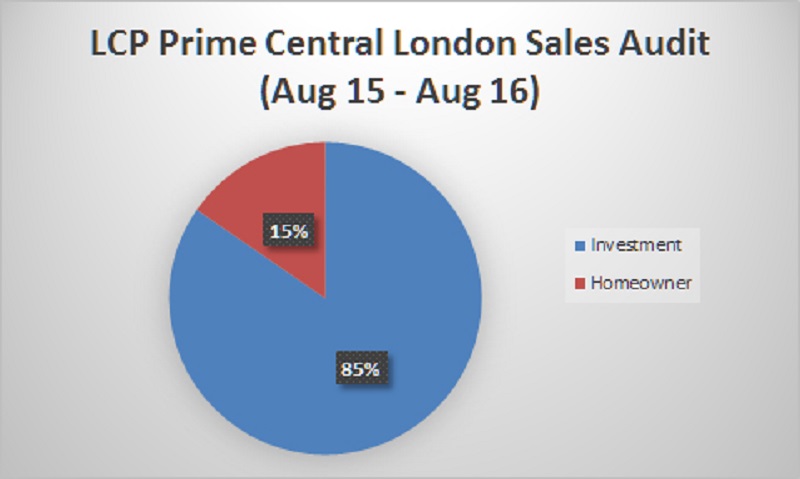

The LCP have also looked at their client portfolio which has shown that a number of buy to let investors in this market has decreased over the course of the last 12 months. The investor share of the market has dropped from 85% to 55%. On the other hand, homebuyers in Prime Central London have increased, now representing 44% of the market. It has been shown by the property advice company that home buyers are looking to purchase luxury properties that have been discounted and are now within their budget. The increase in opportunistic buyers has led to an increase in the number of purchases taking place in the £5 – £10 million price bracket, with a 23% increase in sales. On the other end of the spectrum there has been a 9.4% decrease in sales taking place in the £1 million and under price bracket. The average purchase price of rental investors has also seen a significant decrease of 27%.